So, how do I get financially free?

The income of your investment or passive source cover your living expenses.

You have to accumulate enough money or have enought passive income that the interest on that money make you more than you spend.

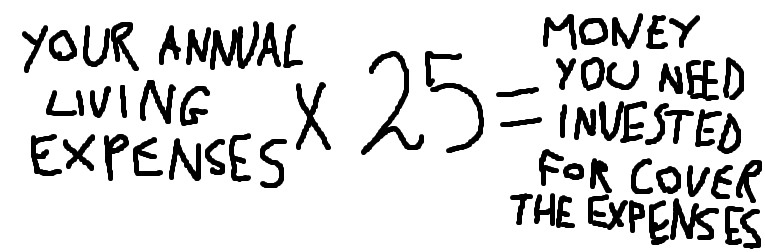

How much money do you need to accumulate?

To answer at this question you need to know your annual expenses and multiply it for 25.

(4% Rule of thumb. This rule says that if you withdraw the 4% every year from your investment, you have high probability of withdraw it for 30 year. 100 / 4 = 25 = number of times you need to multiply your annual expenses for having the neccessary capital. )

| Annual Living Expenses | Money you need invested for cover those expenses |

| 6000 (500$/month) | 150 000 $ |

| 9000 (750 $/month) | 225 000 $ |

| 12000 (1000 $/month) | 300 000 $ |

| 18000 (1500 $/month) | 450 000 $ |

| 24000 (2000 $/month) | 600 000 $ |

Easy, right? Have 300 000 $ invested and you will have 1000 $/month for the rest of your life (with high probability) without doing anything.

For someone starting from 0. That’s hard. But, nothing is impossible with the right knoledge, effort and time. Yes It take time. So better start thinking long term.

At the end of this post you can find a link for a simple free calculator created by me.

Before, let’s see togheder the deepest math of this problem..

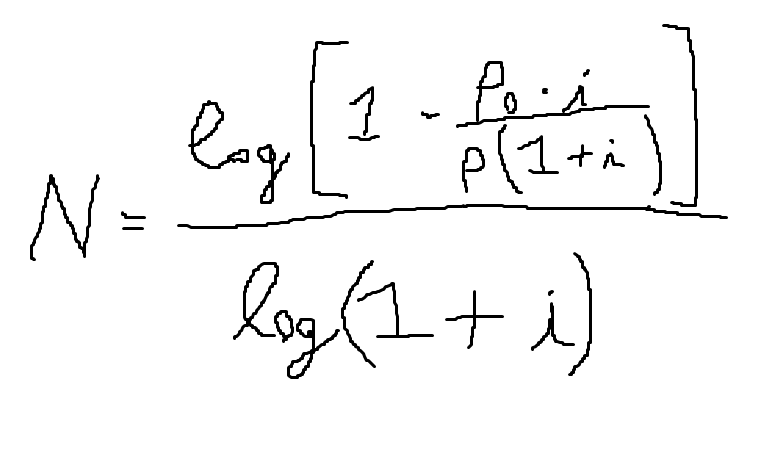

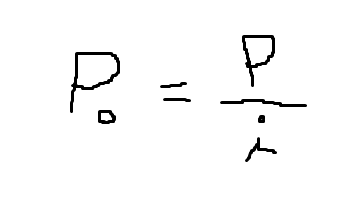

The number of year you can live with you money invested:

Where:

Po = initial capitale

P= annual withdraw

i = annual interest

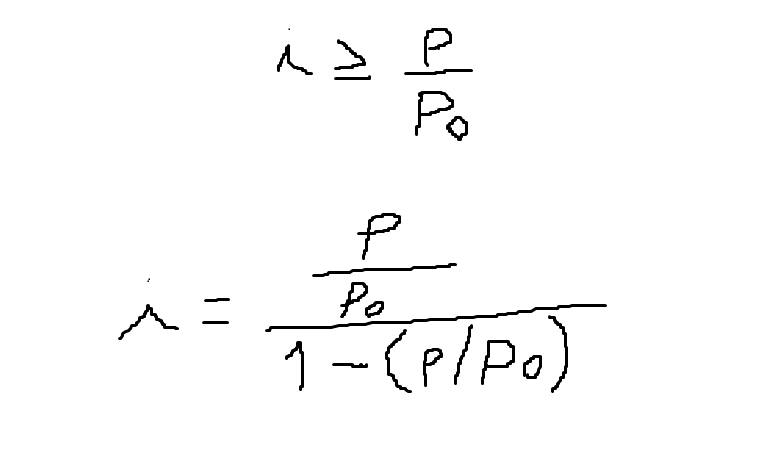

When you can live forever from your investment

Mathematecally you can live forever with your money invested when:

The second one indicate the interest rate when you withdrawls egual the gain.

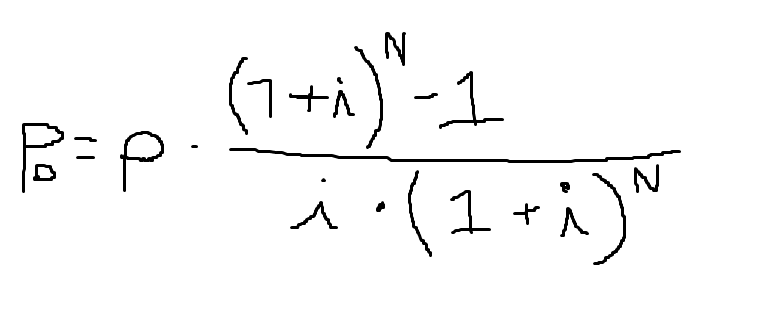

How much money do you need

if you know the number of year the money need to last, you can use this formula:

Where Po = Initial capital

p = annual withdraw

i = annual interest rate

N= duration of the capital in years

For example, if you want 20 000 €/year at 5% interest rate, you need 306 000 €

If you want that your money last forever you need:

For example: like before for having 20 000 $ /year forever at 5% you need: 400 000 $

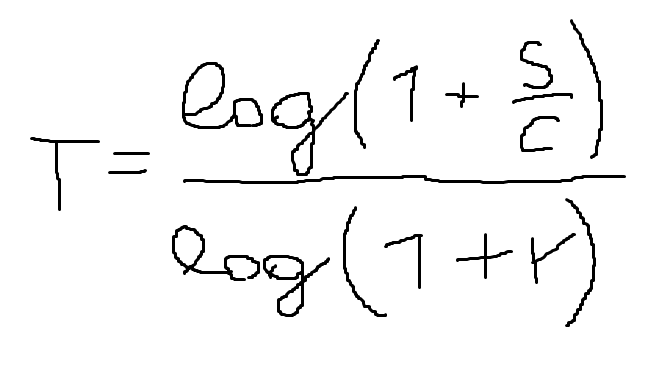

How many year of work do you have do to to live of your assets?

this depents on your income and your rate of saving.

Where: T = remaning year of work before financial indipendence

s = annunal saving

c= annual expenses

r = annual return on investment

with 5% annunal return

| Saving rate | Years for financial indipendence |

| 10% | about 51 years |

| 25% | about 32 years |

| 40% | about 22 years |

| 50% | about 17 years |

| 60% | about 12 years |

| 70% | about 9 years |

| 80% | about 6-7 years |

| 90% | about 4 years |

For example if you gain 30 000 $ every year and save 15 000 $. Your saving rate is 50% -> 17 year of work

if you keep your expense fixed and you improve your annual gain at 45 000 -> your saving rate is 66% -> you can react FIRE in less than 10 years.

Here you can find a calculator.

Let me know in the comments what you think and if I missed something or If I can improve the calculator in any way.

Teo